TransactionManager Debug and Trace events

While working on a project, from time to time, we might request the TransactionManager 'Debug' and 'Trace' events.

The Debug event is the one created by the org.jpos.transaction.Debug participant and looks like this:

JCARD

100.55

org.jpos.iso.channel.CSChannel@71e13a2c

open \[0.6/0.6\]

prepare-response \[6.0/6.6\]

close \[1.0/7.6\]

end \[15.3/15.3\]

Sun Feb 12 22:47:39 UYST 2012

txnmgr

org.jpos.ee.DB@7a315068

100.55 (notsupported prepareresponse close sendresponse)

invalid.request

Unsupported transaction

...

...

It basically dumps the Context. On the other hand, the Trace event usually comes after the Debug (provided the TransactionManager's trace property is set to true) and looks like this:

txnmgr-1:2

prepare: org.jpos.jcard.PrepareContext NO_JOIN

prepare: org.jpos.jcard.CheckVersion READONLY NO_JOIN

prepare: org.jpos.transaction.Open READONLY NO_JOIN

prepare: org.jpos.jcard.Switch READONLY NO_JOIN

groupSelector: notsupported prepareresponse close sendresponse

prepare: org.jpos.jcard.NotSupported NO_JOIN

prepare: org.jpos.jcard.PrepareResponse NO_JOIN

prepare: org.jpos.transaction.Close READONLY

prepare: org.jpos.jcard.SendResponse READONLY

prepare: org.jpos.jcard.ProtectDebugInfo READONLY

prepare: org.jpos.transaction.Debug READONLY

commit: org.jpos.transaction.Close

commit: org.jpos.jcard.SendResponse

commit: org.jpos.jcard.ProtectDebugInfo

commit: org.jpos.transaction.Debug

head=3, tail=3, outstanding=0, active-sessions=2/2, tps=0, peak=0, avg=0.00, elapsed=22ms

prepare: org.jpos.jcard.PrepareContext \[0.0/0.0\]

prepare: org.jpos.jcard.CheckVersion \[0.0/0.0\]

prepare: org.jpos.transaction.Open \[0.5/0.6\]

prepare: org.jpos.jcard.Switch \[0.0/0.6\]

prepare: org.jpos.jcard.NotSupported \[0.1/0.7\]

prepare: org.jpos.jcard.PrepareResponse \[5.8/6.6\]

prepare: org.jpos.transaction.Close \[0.0/6.6\]

prepare: org.jpos.jcard.SendResponse \[0.0/6.6\]

prepare: org.jpos.jcard.ProtectDebugInfo \[0.0/6.7\]

prepare: org.jpos.transaction.Debug \[0.0/6.7\]

commit: org.jpos.transaction.Close \[1.0/7.7\]

commit: org.jpos.jcard.SendResponse \[4.3/12.0\]

commit: org.jpos.jcard.ProtectDebugInfo \[0.2/12.3\]

commit: org.jpos.transaction.Debug \[9.3/21.7\]

end \[22.8/22.8\]

UPDATE - in recent versions of jPOS, the Debug and Trace events are placed together by the TransactionManager.

Quick note to let you know that as of subversion r3019, new jPOS development will take place in

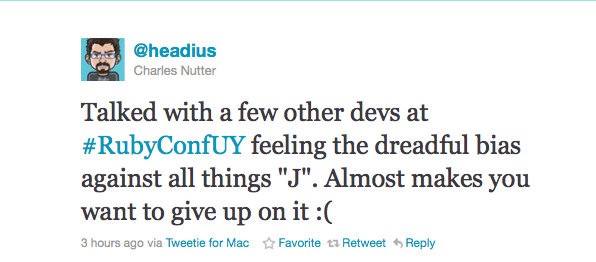

Quick note to let you know that as of subversion r3019, new jPOS development will take place in  So I tried latest JRuby on latest jPOS, it took just a few minutes. I've added an optional 'jruby' module to jPOS-EE (just depends on the 'commons' module) and you can now deploy a QBean that looks like this:

So I tried latest JRuby on latest jPOS, it took just a few minutes. I've added an optional 'jruby' module to jPOS-EE (just depends on the 'commons' module) and you can now deploy a QBean that looks like this: